Tuesday was mixed day for our markets. Harvest corn closed down 1 3/4, harvest soybeans closed down 3, harvest winter wheat closed up 4 3/4 and harvest spring wheat closed up 3/4. In the overnight trade all of our markets are now on the positive side. Oil closed up $1.96 yesterday at $59.09 per barrel. It is stronger in trading again this morning with it now valued at $59.58 per barrel. Our dollar started out yesterday morning at $0.723 US and then trended higher going up to $0.727 US in the afternoon. It has eased back some since then with it currently valued this morning at $0.725 US.

Speculative funds are now holding a record large short position in the wheat market. They are betting on prices going even lower this year. Although the prospects for a strong crop in the US has strengthened recently with an improving good to excellent rating for their winter wheat crop and the quick planting pace for their spring wheat crop there are production concerns in other parts of the world. Currently in China they are experiencing a heat wave over a major wheat growing region that will be stressing their crop. Also the Black Sea growing region is considered very dry and this should be hindering production levels in both Russia and Ukraine. If something occurs to rally this market the speculative funds will most likely be panic sellers and this should push prices higher and faster than normal supply demand fundamentals would indicate.

Corn prices have been trending lower and the quick planting pace confirmed this week by the USDA should continue this trend. A favourable for planting weather forecast for the next two weeks will also support lower prices going forward. Even with the strong exports this year the corn market will need a weather scare to drive new crop prices higher.

News this morning that high level diplomats from the US and China would be meeting this weekend in Switzerland to discuss trade issues have helped to rally prices for our commodities. Although President Trump talks that trade deals can be made very fast most analysts feel that any significant deal will take months to work out all the details. Nevertheless it is nice to see our markets rally just with the announcement of the first meeting.

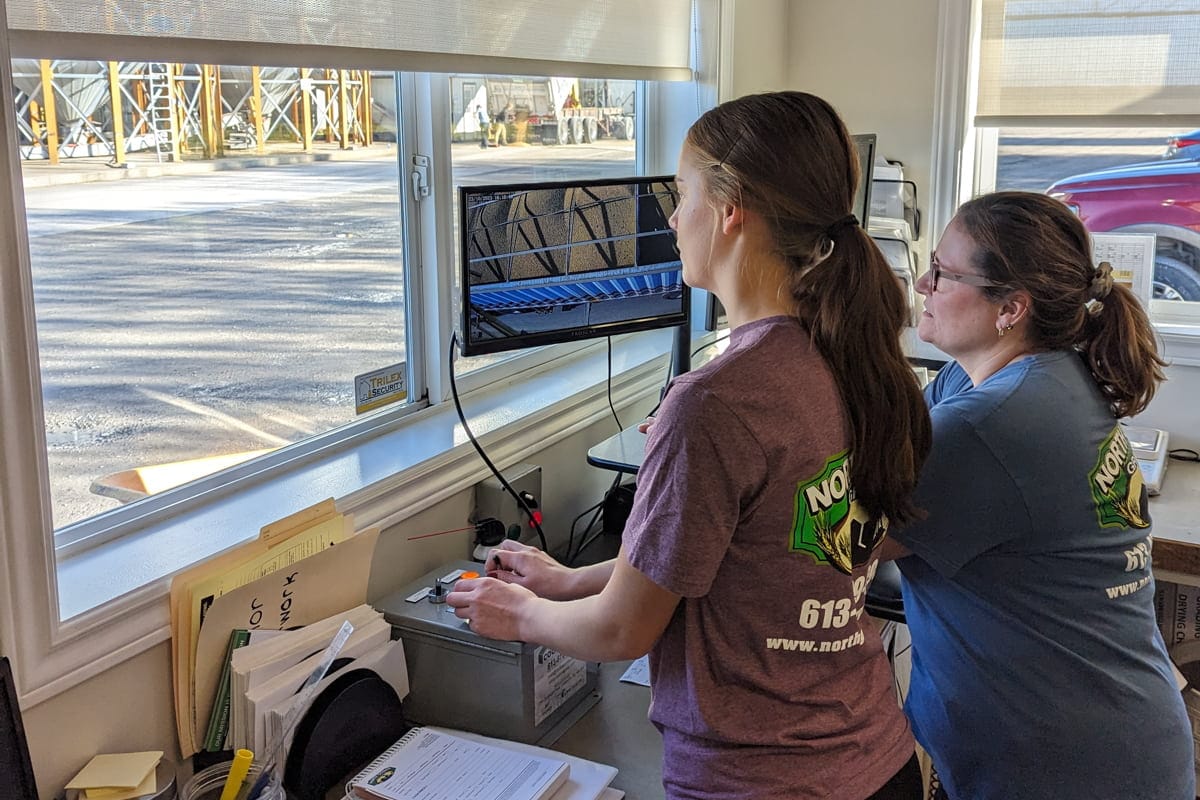

If you would like to talk about the markets or price some of your crop for the future or in store, please reach out to us via phone or email to info@northgowergrains.com. Prices quoted herein are for product at our elevator.

Delores Seiter | 613-880-7458

Bob Orr | 613-720-1271

Office | 613-489-0956