Our Annual Customer Appreciation Day is less then 2 weeks away. Wednesday, June 25, 2025. Mark your calendar.

Thursday was a mixed day for our markets. Harvest corn closed up 3/4, harvest soybeans closed down 2, harvest winter wheat closed down 7 3/4 and harvest spring wheat closed up 4 1/2. In the overnight trade corn is negative with soybeans and the wheat sector on the positive side. Oil closed down $0.11 yesterday at $68.04 per barrel. It is stronger this morning with it now valued at $73.43 per barrel. Our dollar has traded between a low of $0.733 US and a high of $0.736 US over the last 24 hours. This morning it is currently valued at $0.734 US.

Oil prices have jumped up the last few days with an escalation of hostilities between Israel and Iran. Fears of an all-out war between the two countries have made the news wire. This is raising concerns on how it might affect oil supplies going forward and as such prices have jumped up.

The WASDE report yesterday ended up being kind of dud of a report. Corn exports out of the US were increased by 50 million bushels with carryout stocks decreased by the same amount. Unfortunately, this was not enough to drive the corn market higher. Wheat exports were also increased by 25 million bushels for this year with the same change to carryout stocks. The markets will now be waiting for the Final Planted Acres report that gets released at the end of this month.

New crop soybean prices have fallen below their 20, 50 and 100 day moving averages. They are being pressured with favourable growing conditions so far this spring in the US and of course the large supply produced this year in South America. The uncertainty of the ongoing trade talks and how this will affect soybean demand is also weighing on prices.

The supply side of the world wheat market is putting pressure on wheat prices. India is looking at a record wheat harvest with crop prospects in the EU and Russia recently getting better. Also rains over the last week or so in the dry growing regions of China will likely decrease the amount of wheat that China will need to purchase over the coming year.

Friday’s thought: You must develop the ability to be disliked in order to free yourself from the prison of other people’s opinions.

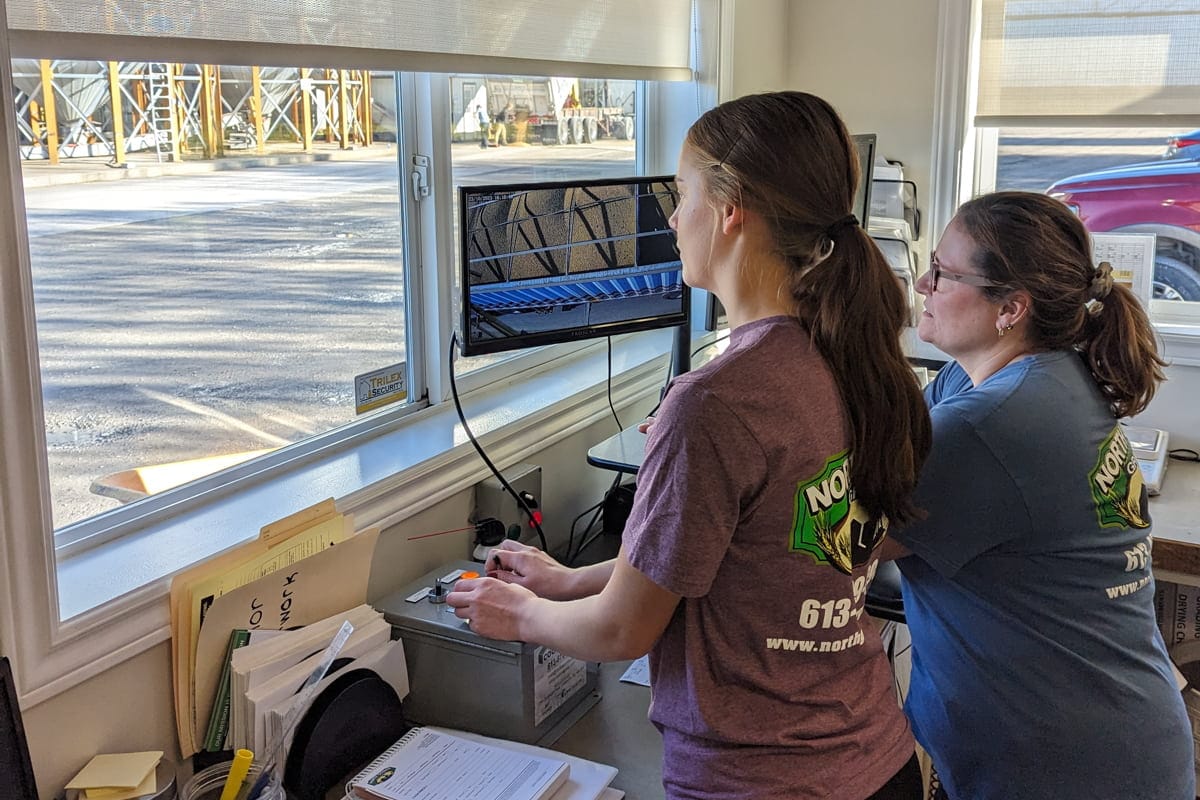

If you would like to talk about the markets or price some of your crop for the future or in store, please reach out to us via phone or email to info@northgowergrains.com. Prices quoted herein are for product at our elevator.

Delores Seiter | 613-880-7458

Bob Orr | 613-720-1271

Office | 613-489-0956